Marketing Authorization & Regulatory Requirements For Drug Registration In Thailand

Generic drug registration in Thailand can be a streamlined process, particularly if you understand the relevant regulations and requirements. Familiarity with the regulatory landscape and compliance criteria can significantly simplify the application and approval process for generic drug registration in Thailand, making it a more manageable and efficient undertaking.

Thailand is the second-largest healthcare market in Southeast Asia after Indonesia making up roughly 20% of the region’s expenditure.

Thailand’s pharmaceutical market is the eighth largest in the Asia Pacific region and is considered one of the largest and most developed in ASEAN.

Top 5 reasons to choose Thailand as your generic drug market

Thailand’s generic market presents numerous opportunities for foreign pharmaceutical companies

Thailand is a leading hub of generic drugs for its

- Huge market size due to

- Aging population,

- The general trend in increasing risk of illness such as High blood pressure, Diabetes, Heart disease, Strokes, Cancer, and communicable diseases such as HIV/AIDS, Tuberculosis, Dengue fever, etc. and,

- Growth of medical tourism

- Government support

- The Thai government has policies and initiatives in place to promote the use of generic drugs as a cost-effective alternative to brand-name medications. This support can facilitate market entry and growth for generic drug companies.

- New Regulations that no longer require state agencies to purchase from the Government Pharmaceuticals Organization (GPO), the state-run agency for pharmaceuticals and medical equipment provide a huge opportunity for foreign pharmaceutical companies.

- The Government of Thailand supports the usage of general medicines in government-run hospitals

- Thailand hospitals purchase about 75% of all medicinal drugs fabricated and sold locally in Thailand usually based on Generic tenders.

- Regional Hub: Thailand serves as a regional hub for the distribution of pharmaceuticals in Southeast Asia. This strategic location can be advantageous for companies looking to expand their presence in the broader region.

- Diverse Portfolio: Offering a diverse portfolio of generic drugs to cater to various medical conditions can be a successful strategy in the Thai market.

Thailand vs. other ASEAN countries

- The Thai Generic market is large and fast-growing, with the government remaining the biggest client for the industry.

- Entry into the Pharmaceutical Inspection Co-operation Scheme (PIC/S) opens the way for Thai manufacturers of medicines and medical supplies to expand their exports to the ASEAN region

- The Board of Investment (BOI) (through tax exemption) is making an effort to invite pharmaceutical companies to invest in Thailand.

- Thailand imports pharmaceuticals and medical devices to overcome the needs of the healthcare sector and Thailand imports about 90% of the ingredients used to produce the final products.

Need support for your drug registration in Thailand?

Credevo offers expertise in drug product registration, clinical trial regulations, and many more services in Thailand. Check them out now!

Potential therapeutic area for generics in Thailand

The potential therapeutic areas for the generic drug market in Thailand can be influenced by several factors, including the prevalence of diseases, government healthcare priorities, and market demand. Here are some therapeutic areas with potential opportunities:

- Cardiovascular Diseases: Cardiovascular diseases, such as hypertension and coronary artery disease, are significant health concerns in Thailand. Generic versions of commonly prescribed cardiovascular medications can find a substantial market.

- Diabetes: With the increasing prevalence of diabetes in Thailand, there is a growing demand for generic diabetes medications, including insulin and oral hypoglycemic agents.

- Infectious Diseases: Thailand faces challenges related to infectious diseases, including HIV/AIDS and tuberculosis. Generic antiretroviral drugs and antibiotics can be essential in managing these conditions.

- Respiratory Disorders: Respiratory diseases like asthma and chronic obstructive pulmonary disease (COPD) are prevalent. Generic inhalers and bronchodilators can cater to this patient population.

- Cancer: As cancer rates rise, generic oncology drugs, including chemotherapy and supportive care medications, may find a market in Thailand.

- Central Nervous System Disorders: Medications for neurological and psychiatric disorders, such as epilepsy, depression, and schizophrenia, can be in demand in Thailand.

- Gastrointestinal Disorders: Generic drugs for gastrointestinal conditions like acid reflux, ulcers, and irritable bowel syndrome can be popular among Thai consumers.

- Pain Management: Chronic pain management is an important aspect of healthcare. Generic pain relievers and anti-inflammatory drugs can address this need.

- Women’s Health: Generic contraceptives, hormone replacement therapies, and drugs for conditions like menopause can be sought after in the women’s health segment.

- Dermatology: Skin conditions and dermatological disorders are common. Generic creams, ointments, and topical medications can cater to this market.

Thailand’s pharmaceutical market size

- In 2021, the pharmaceutical market in Thailand had an estimated worth of $6.4 billion, making it the second-largest in Southeast Asia, trailing only behind Indonesia. Furthermore, the medical devices market in Thailand reached a valuation of $6.3 billion in 2020.

- The Domestic market has about 160 companies that import Pharmaceutical ingredients, produce and sell them as Generic to Thai consumers and the Market value is estimated to be 1 Million US$.

- The export of Pharmaceutical products has grown steadily over the years and most Pharmaceuticals were exported to ASEAN regions like Myanmar, Vietnam, Cambodia, etc.

- Almost 90% of Pharmaceutical trade comes from Generic drugs and Generics are mainly imported from China, India, United States, Germany, France, and Switzerland.

Global Footprints in Thailand

Prominent foreign pharmaceutical companies that operate in Thailand include GSK, Sanofi, Roche, AstraZeneca, and Novartis

Some of the Foreign pharmaceutical companies also manufacture products in Thailand.

- PharmaCyte Biotech (Laguna Hills, CA) announced that the company would be using Austrianova’s existing live-cell encapsulation facility in Bangkok.

- Teva Pharmaceutical (Israel) owns a Thai generics manufacturer, Silom, after acquiring Actavis in 2016.

- Not only multinational drug firms have made investments in in-country facilities but even foreign pharmaceutical companies generally employ several large Thai contract manufacturers to either re-package their imported drugs or produce their products locally.

Requirements & procedure to Register Generic drugs in Thailand

- Regulatory Body: The Drug Control Division of the TFDA (Thai Food and Drug Administration) is responsible for registration, licensing, surveillance, inspection, and adverse event monitoring for all pharmaceuticals and pharmaceutical companies in Thailand

- Application Format: The format followed for submission and drug registration is ACTD (ASEAN Common Technical Document) and additional country-specific requirements

- Type of Application: Registration requirements differ for general drugs such as generics, new medicines, new generics, and traditional drugs.

Type of generic drugs

- Generic drug

- New generic drug

Generic Drug

Pharmaceutical products with the same active ingredients and the same dosage forms as those of the original products, but manufactured by different manufacturers are considered Generics

Registration requires only dossiers on product manufacturing and quality control along with product information

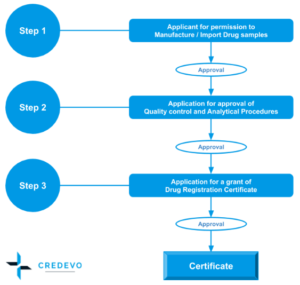

Procedure

Applications are made to the FDA

- Step 1: Companies and individuals wishing to enter a drug on the market must obtain a license from the FDA to manufacture, sell, or import drugs in Thailand.

- Step 2: Application for approval of drug quality control and analytical methods. (at the Department of Medical Science)

- Step 3: Then the licensed applicant must obtain FDA registration for the medicine to market and sell the drug in Thailand.

- The applicant should submit various details about the drug production process to be used, including:

- Manufacturing methods.

- In-process controls.

- Specifications of the active ingredients

- Excipients used in the production process

- To register new generics, the FDA requires dossiers of bioequivalence studies, besides

- Information about the drug storage conditions and details about the stability of the drug is also required

New Generic Drug

Medicines with the same active ingredients, doses, and dosage forms as those of the new compounds registered after 1992 are considered New Generics

- Registrations require dossiers of bioequivalence studies in addition to the required dossiers for generics submission.

Procedure

- A protocol for a bioequivalence study must be submitted for approval at the Drug Control Division.

- Application to seek permission to import or manufacture the drug samples.

- Performing the bioequivalence study according to the approved protocol in a specified government institute.

- Submitting an application for registration along with the bioequivalence report and other useful documents. [2][8]

Generic & New Generic Comparison

| Type | Generic drug | New Generic Drug |

| Dossier Requirements | 1. Product Manufacturing 2. Quality Control 3. Product Information | 1. Bioequivalence Studies 2. Product Manufacturing 3. Quality Control 4. Product Information |

| Process | 1. Obtain a license from the FDA to manufacture, sell or import drugs 2. Application for approval of drug quality control and analytical methods 3. Obtain FDA registration for the medicine to market and sell the drug in Thailand | 1. A protocol on bioequivalence study for approval at the Drug Control Division 2. Obtain a license from the FDA to manufacture, sell or import drugs 3. Application for approval of drug quality control and analytical methods 4. Obtain FDA registration for the medicine to market and sell the drug in Thailand |

| Timeline | 4-5 Months | 5-6 Months |

Review fast track

Drug application for generics can be processed in either of the two-track depending on the needs of the patients.

- Track 1: Standard view which takes approximately 110 working days.

- Track 2: Accelerated or Priority Review (Drugs for public health problems/life-threatening) which takes about 70 working days.

Process flow

Requirements for drug registration in Thailand

- Administrative Documents

- Drug Product

- Non Clinical Documents

- Clinical Documents

| Administrative Documents | Drug Product | Non Clinical Documents | Clinical Documents |

| 1. Application Form 2. Copy of Valid Certificate of Brand Name Clearance 3. Certificate of a pharmaceutical product (COPP) 4. GMP 5. License For Pharmaceutical Manufacturing 6. Site master file (SMF) 7. Permission For Manufacturing & Marketing 8. In Country of Origin 9. Letter of authorization (LOA) 10. Labeling Documents 11. Patent Information 12. SPC Patient information leaflet (PIL) 13. Mock Up And Specimen 14. Environmental Risk Assessment (Depends) | 1. Description & Composition 2. Pharmaceutical Development 3. Manufacture 4. QC of Excipients 5. QC of Finished Product 6. Reference Standard 7. Container Closure System / Packing 8. Product Stability 9. Product Interchangeability | 1. Non-Clinical Overview 2. Literature References | 1. Clinical Overview 2. Clinical Study Reports (Only Bioequivalence) |

Thailand’s current and future Market

- According to the IMF (International Monetary Fund), Thailand’s GDP based on Purchasing Power Parity (PPP) exceeded $1.1 trillion in 2016, making Thailand the second largest economy in Southeast Asia after Indonesia, which has a GDP of $3 trillion.

- Thailand imported over $2.2 billion in pharmaceuticals in 2016, an increase from $1.8 billion just two years ago, and in 2016, over 65% of Thailand’s pharmaceutical imports came from the United States, Europe, and Canada, and Germany Also the largest pharmaceutical exporter to Thailand, followed by the US, France, then Switzerland.

- The Thai pharmaceutical market was valued at over $5 billion in 2016 and the current value of $7 Billion making it the second-largest market in Southeast Asia the value of Thailand’s pharmaceutical market is expected to double by 2020.

- Revenue in the OTC Pharmaceuticals market amounted to US$ 990m in 2019. The market is expected to grow annually by 0.7% (CAGR 2019-2023) and Pharmaceutical sales per capita are also predicted to grow from $75 in 2016 to $125 by 2024.

Do you need support or have queries on drug registration requirements?

Credevo offers a wide range of drug development and regulatory services in Thailand. Choose one of the following options to connect with us.

Get the report on Thailand’s generic drug registration process.

Note: This report will be charged @ $359.

Do you have a query? Just ask experts at Credevo.

Note: “Ask Credevo Expert” will be charged @ $50 / inquiry. Any inquiry requiring more than 30 min of the expert’s time will incur additional charges.

Looking for a quotation? Just provide relevant info and we will send you the details.

One thought on “Marketing Authorization & Regulatory Requirements For Drug Registration In Thailand”

Comments are closed.